Not Having a Bitcoin Allocation Strategy is Perhaps a Financial Blunder for the Ages

By Mike Cautillo | In my opinion | No CommentsGood Day,

One of the more interesting developments with Bitcoin adoption over the last few years has been institution’s, corporations’, & businesses’ increased appetite to hold some. While some have purchased the bitcoin to add to their treasury, others have participated via a fund as a proxy. Each with their own unique objective.

Here’s a website that is solely dedicated to tracking various entities’s bitcoin allocations as per public info. & disclosures. https://bitcointreasuries.net/

It’s mainly an interesting development because the aforementioned are typically some of the most prudent cashflow managers, many businesses alike understand that cash is the lifeline of their operation. And given Bitcoin’s volatility, you wouldn’t think it’s desirable for these entities at first glance.

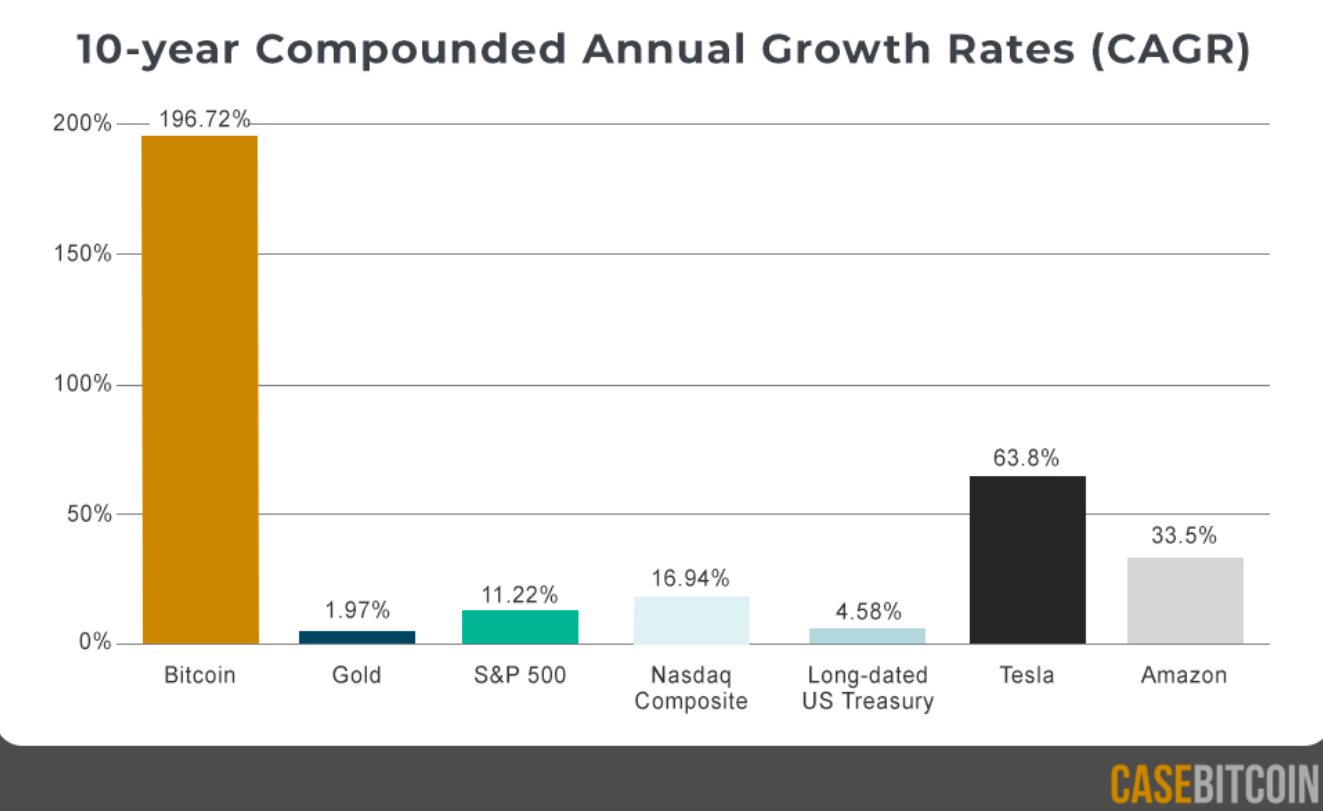

But having said that, it’s difficult to continue to ignore bitcoin’s outsized returns over its 14-year life span (see charts below), while equally becoming impossible to ignore what has happened to the value of fiat dollars after years of devaluation via inflation, https://infogram.com/value-of-one-us-dollar-in-the-last-50-years-1hzj4o3exm13o4p/. Sitting on excess cash reserves has necessitated the need to insure against value erosion. Bitcoin has become a worthy allocation in this regard thus far.

Legendary hedge fund managers like Paul Tudor Jones, George Soros, and Stanley Druckenmiller have made room for it in their portfolios. MassMutual, an insurer founded in 1851, purchased $100 million of bitcoin in December 2020. Large pensions & endowments such as Yale, Harvard & Brown which are some of the most sophisticated yet conservative investors in the world own bitcoin. The Houston Firefighters’ Relief and Retirement Fund (HFRRF), the pension fund for the City of Houston’s firefighters purchased bitcoin for the defined benefit plan’s portfolio.

One of the most noteworthy corporate Bitcoin advocates & accumulators of course has been Michael Saylor, CEO of MicroStrategy which has amassed ~140,000 bitcoin on their balance sheet since fall of 2020.

Despite who’s been jumping in, a new trend of accumulators has emerged & providing Bitcoin continues to work as effective as it has thus far, I don’t see this trend subsiding either. And given what I believe is the continuation of devaluing fiat currency globally, it will only accelerate in my opinion which perhaps makes not having a Bitcoin allocation strategy a financial blunder for the ages!

Until next time…….

Charts courtesy of https://twitter.com/case4bitcoin

Charts courtesy of https://twitter.com/case4bitcoin

“When you arise in the morning think of what a privilege it is to be alive, to think, to enjoy, to love …”- Marcus Aurelius

Recent Comments