Good day,

“The stock market is filled with individuals that know the price of everything but the value of nothing.” -Philip Fisher

When I think of how most people currently measure their financial wealth, I can’t help but think of how prescient this quote truly is.

Fisher’s insight is the impetus for a mirage that is more vivid now than ever. This mirage is increasingly presenting itself as many remain accustomed to measuring their net worth in nominal terms only & not in real value.

First, the respective distinction, as per Wikipedia,

“In economics, nominal value refers to value measured in terms of absolute money amounts, whereas real value is considered and measured against the actual goods or services for which it can be exchanged at a given time. Real value considers inflation and the value of an asset in relation to its purchasing power.”

I posit that in a world where central banks & government deficits have run the gamut on currency issuance, we must reimagine alternative measures of how to gauge the real value of one’s holdings. The art of this exercise, if you will, is to index a new numeraire, by acquiring something that is provably & functionally rarer & economically scarcer, such as Bitcoin &/or gold. Without actively recalibrating purchasing power in relative terms, you run the risk of conflating the mirage noted above with reality.

Here’s a visual on the price history for gold, silver, and Bitcoin, with the horizontal axis now representing the purchasing power of fiat going back 150 years. (wherein 1874 = $1)

H/T-https://twitter.com/TimmerFidelity/status/1760677789865512980

H/T-https://twitter.com/TimmerFidelity/status/1760677789865512980

By commencing to accumulate exposure to these *monies* (I consider Bitcoin & gold to be global base money as per- https://twitter.com/1basemoney/status/1759580900684079343), one can build a lever of sorts. As the weight of devaluating currency inevitably continues to intensify by proxy of the economy’s demand & its respective debt load, perhaps counteracting this force via adopting a different UoA as a form of savings is an idea worthy of strong consideration.

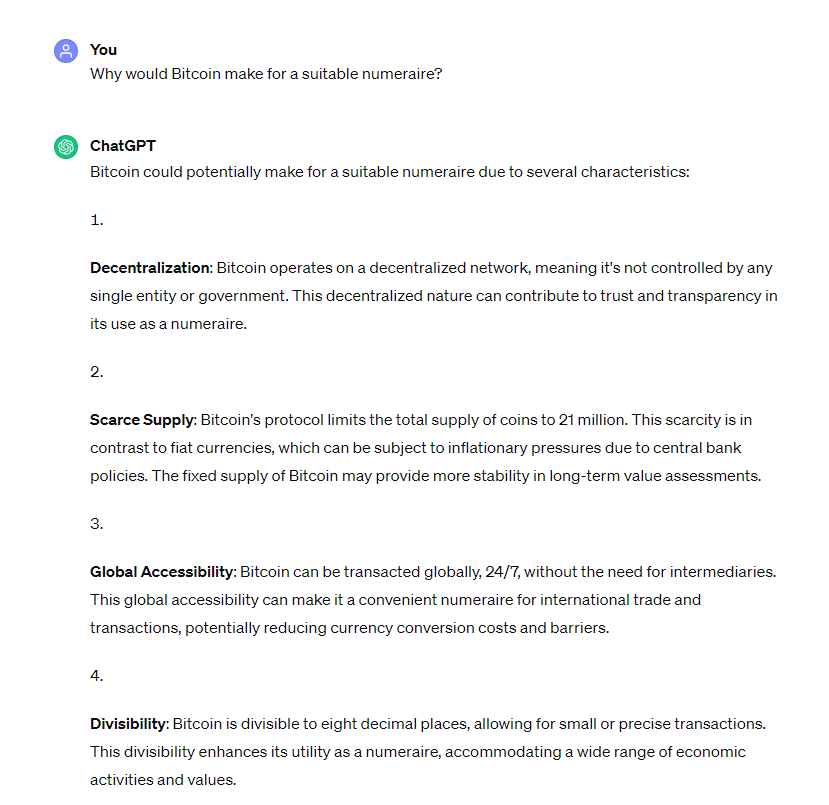

Out of curiosity, I prompted ChatGPT by asking, “Why would Bitcoin make for a suitable numeraire?” I must admit that the response was noteworthy.

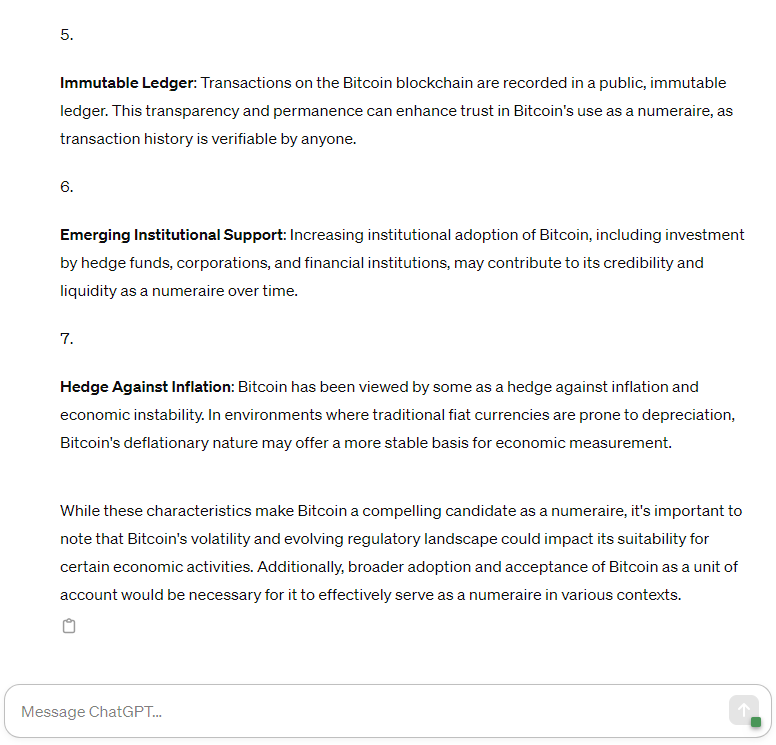

As ChatGPT noted, there are those who will argue that Bitcoin is too volatile to effectively perform the numeraire function. I disagree, & for the context of this argument, let’s assume one maintains the correct position sizes in various periods as Bitcoin is emergent. I would argue that it’s more appropriate to claim that bitcoin’s price is in the interim sensitive to things such as central bank uncertainty & sovereign debt burdens & not in any way due to a lack of its own stability. Bitcoin’s issuance & supply are the most stable of any commodity produced in the world, in fact devoid of any volatility, as it has been fixed in code & supported by network consensus since its genesis.

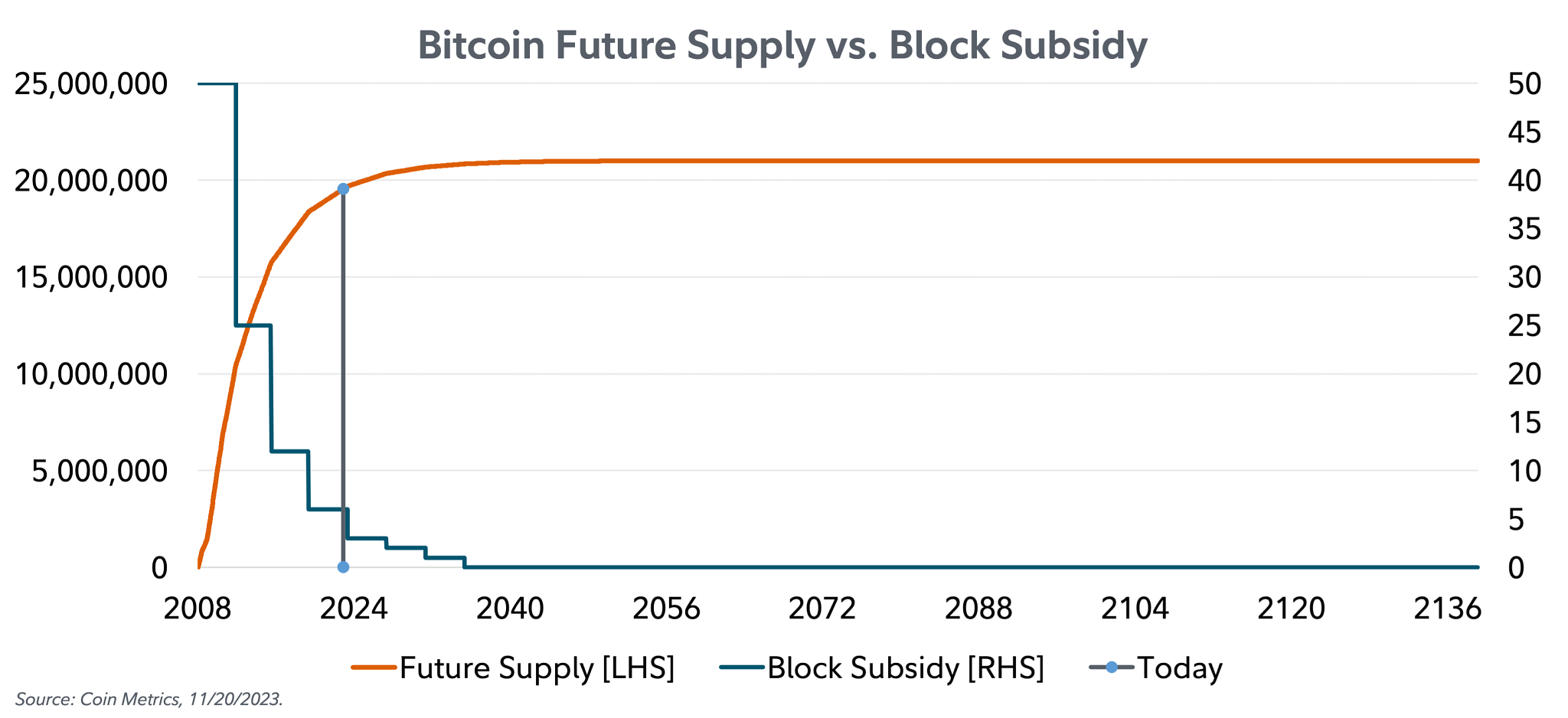

Albeit I’ve presented a perspective in which I believe it has become imperative to measure & track the real value of one’s financial wealth via another numeraire such as Bitcoin, I reckon the USD will continue to be the fiat currency of choice for the global economy & world trade for the foreseeable future.

H/T–https://www.visualcapitalist.com/visualizing-currencies-decline-against-the-u-s-dollar/

H/T–https://www.visualcapitalist.com/visualizing-currencies-decline-against-the-u-s-dollar/

Lastly, I’d like to leave you with a two quotes, which are often a source of contemplation for me when thinking about the current state of US hegemony……

“A fundamental reform of the international monetary system has long been overdue. Its necessity and urgency are further highlighted today by the imminent threat to the once mighty U.S. dollar.” –Robert Triffin (1960)

“Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.”-Winston Churchill (1942)

Until next time, be well & thanks for being here……

P.S. Please have a look around our new site.

Recent Comments